My First Home

Enjoy the Journey

Whether buying or building, the path to home ownership should be fun and exciting, as well as affordable. The Charleston real estate market offers many opportunities to find the place to call “home”. Whether you want a single-family home or the convenience of a townhome, you can own for about the price as renting—possibly even less! With current interest rates and mortgage programs with low down payments, get ready now to make your move!

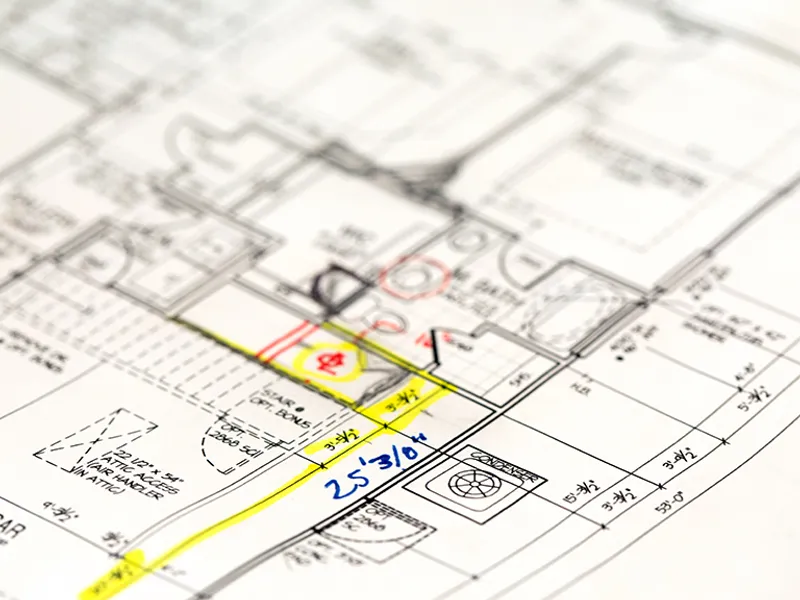

Floor Plan That Fits Your Needs

Why renovate a home to make it fit? Start from your vision and, step by step, make it happen. When you choose to build a new home, you choose the floor plan and all the details. Don’t make your lifestyle fit into an existing home. Make this important investment the other way around.

- Slide 1

- Slide 2

- Slide 3

You should talk about your plans with a lender before you start looking for a new home. A mortgage professional can review all your options to find the one that best suits your financial situation. You can get guidance for improving your credit, if necessary, and also receive pre-approval, which tells the seller that you’re a qualified (and serious) buyer.

Your lender will review the costs that go into closing on a new home and the monthly payments to sustain it. They take into consideration many variables such as debt to income ratio, credit scores, and down payment contribution (to name just a few) when determining how much you can afford. You can get a rough estimate by using this mortgage calculator.

We know that buying your first home can feel a bit scary, so we often provide cost-saving ways to make it even more affordable. Click here to learn about Hunter Quinn Homes’ current incentives.

You can choose one of the move-in ready homes on our website, and can close in about 30 days.

If you prefer to build a new home, once you’ve chosen the site, floor plan, and features, and signed the purchase contract, the homebuilding process takes about 6 months.

When the purchase agreement is signed, you’ll write a check for an earnest money deposit, which usually range from $1,000 to $3,000, but there’s no standard amount. These funds are deposited in an escrow account and credited toward your amount due at closing.

Your lender will be able to estimate your down payment and closing costs based on the home you purchase. This way you’ll know approximate costs before you make an offer on your new home.

You will also pay for the home inspection prior to closing, a fee that averages $300 to $350, but depends on the home inspector you choose.

In advance of your closing date, your lender will provide you with a list of the fees to be paid at closing. The down payment is usually 3% to 5% of the purchase price, and will be determined by the mortgage program you choose.

Closing costs also include an appraisal, attorney fees, origination fees, flood certification, and credit fees. The total generally comprises about 3% of the purchase price of your home. In some cases, the seller/builder agrees to pay some of these closing costs.

You’ll pay the closing costs either by wiring the funds or bringing a certified check, but you’ll be advised of the preference by your lender. The bank you currently use for checking/savings should be able to wire the amount or print a certified check for you.

NOW SELLING! Brand New Townhomes in Goose Creek Starting in the Low $300s

Explore Windward TownesSay It!

View Testimonials" Anytime I had any questions or concerns, I'd pick up the phone or shoot an email and within minutes I would get an answer. It was always positive and proactive.... [My Home] was really a joy to build!"